The key to finding the right stocks and best company for investment is fundamental analysis. If you want to get profited in the future, then don’t compromise with analyzing the stocks. You must get insights and data from the companies where you want to invest and analyze all data, reports, and factors. If the result is favorable, then you can buy that company’s stocks without a second thought.

What is Fundamental Analysis?

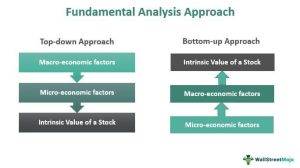

Fundamental analysis is a method that is used to evaluate securities by considering various microeconomic and macroeconomic factors. However, it is one of the most effective ways that will help you analyze the stocks and choose the best stocks for yourself. Now, there are three components in fundamental analysis that you must consider, and those are:

- Economic analysis.

- Company analysis.

- Industry analysis.

How to Do Fundamental Analysis for Stocks?

Just follow my guide and analyze stocks with ease:

Check Company’s Performance

Before investing in the stock market is important to analyze the market and stock so that you can choose the right one and don’t bear the loss in the future. However, you should first understand the company whose stocks you are going to buy. That’s because if you don’t understand the company, it won’t give you an advantage over other investors, and you won’t be able to know will the company perform well in the future or not.

Get all the insights of that company like its goals, performance, decision making, reports, and how leaders are leading this company. These factors will clearly show will this company do well or not in the future.

Financial Reports

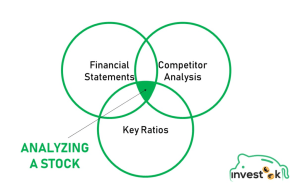

You are all done with understanding the company and its insights. Now, it’s time to study all the financial reports of that company like the balance sheet, loss-profit statement, operating cost, cash flow statement, expenses, and revenue. With these reports, you will be able to calculate Compounded Annual Growth Rate. And, if the data is favorable for you, I mean, if the company’s growth rate has been rising for the last five years, then you can choose the stocks of that company.

Debt Ratio

A company that has a lot to pay to the debtor won’t perform well in the long run. And, if a company has lots of debt, then it won’t reward you the amount that you expect. So, you should always invest in a company that has no debt. Or, make sure you check the “Debt: Equity” ratio that is less than one and invests in that company.

Competitor Analysis

Always look at the competitors of a company where you have invested or going to invest. Find similar companies and see who is doing well. Invest in that company. Make sure it is making good decisions and leading the company well. Besides, it is data, management, and reports are ok; you can put your money on that company.

As an investor, you must always consider analyzing all the reliable data and find out if the company is worth your time and money or not.